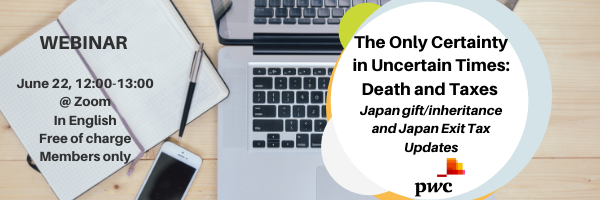

WEBINAR: The Only Certainty in Uncertain Times: Death and Taxes – Japan gift/inheritance and Japan Exit Tax Updates

- This event has passed.

Dear members,

We hereby invite you to a next WEBINAR, this time in cooperation with PwC Japan:

“The Only Certainty in Uncertain Times: Death and Taxes – Japan gift/inheritance and Japan Exit Tax Updates”

Given the current global pandemic environment and looking forward to the future – new normal, have you given some serious thoughts about your own situation? Will you stay in Japan longer term or plan to relocate back to your home country? How will Japan Exit Tax affect you if you do decide to relocate? Have you thought about your/your extended family back home’s estate planning matters? If you do decide to stay in Japan for the longer term, how will Japan gift/inheritance taxes apply to your own situation and your extended family’s estate if you are the expected heir/named beneficiary? Do you have a Will in place in case of any unexpected event happening? We will go over all these difficult but necessary topics within this presentation and hope to address your concerns through a Q&A session at the end.

Speakers from PwC Japan are Marcus Wong, Partner; Jia Ee, Senior Manager; and Thomas Y. Lu, Senior Manager.

You can find their profiles in the attachment.

EVENT DETAILS:

Monday 22 June

12:00-13:00 (45 minutes presentation, 15 minutes Q&A)

In ENGLISH

Free of charge

Members-only

If you are interested, please send an email to info@blccj.or.jp before 22 June 10:00, and we will confirm your registration.

We are still discussing which online platform to use, and will inform asap.

We look forward to welcoming you at the webinar!

The BLCCJ office

You can also find a SUMMARY of the webinar in the attachment.